RAJAR Q3 2025 – Sport and Chill formats increase reach

The latest RAJAR results for Q3 2025 show BBC Radio 5 Sports Extra up 69% to over 1.3 million listeners, and Capital Chill up 50%.

The uplift reflects a busy summer of live sport and the BBC station’s evolution into a more consistent full-time service.

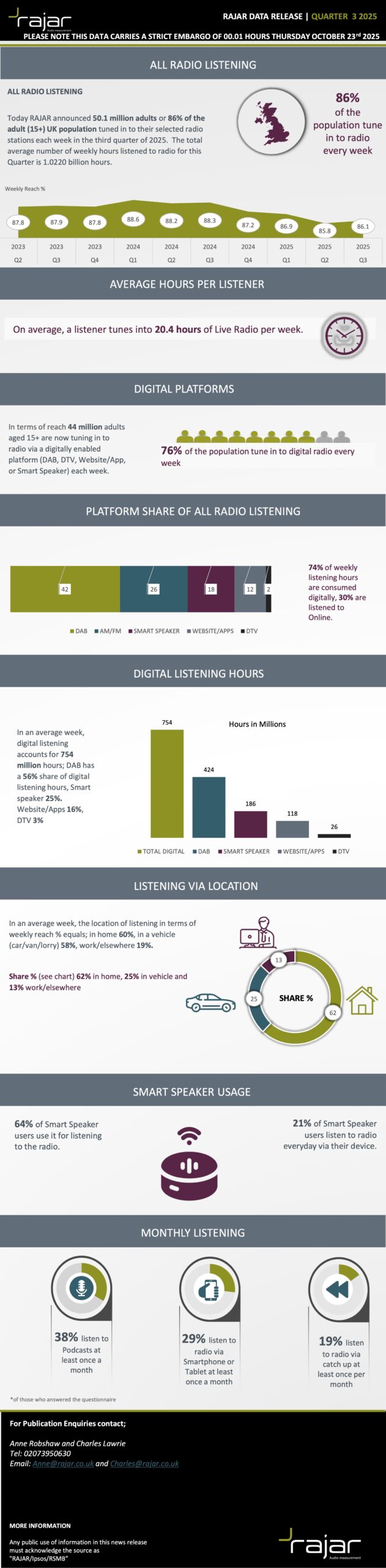

Total UK radio weekly reach edged up 0.3% quarter-on-quarter to 50.1 million listeners, maintaining an 86% weekly reach of adults 15+. Total listening hours slipped 0.4% to 1.02 billion, while commercial radio marginally extended its market share to 56%, up from 53.3% last year. BBC radio now holds 41.7%.

Online and connected listening reached a new high at 29.7%, with smart speakers accounting for 18.2% of all listening hours. Commercial radio’s online share rose to 33%, and its average listening hours increased to 14.4 per listener. The sector now attracts 8.8 million more listeners than the BBC. Radiocentre CEO Matt Payton said the results reflect “a real vote of confidence” in commercial radio’s innovation and strong audience connection.

Listening via DAB and digital platforms now accounts for 77% of all hours, up from 75% a year ago. Online and app-based listening continues to grow, particularly among under-35s, while AM/FM usage has dropped below 20% of total hours for the first time.

RAJAR Q3 2025 further highlights a structural shift, as digital-only and niche spin-offs demonstrate rapid growth when content is distinctive, as seen with Capital Chill, Capital Anthems, and Sports Extra. However, legacy local networks face fragmentation, with Greatest Hits Radio and Hits Radio seeing broad declines in reach.

BBC Radio 2 remains the UK’s most listened-to station, reaching 12.8 million weekly listeners, up 1.3% on the quarter. Scott Mills continues to host the country’s biggest breakfast show with 6.2 million listeners, while Vernon Kay’s mid-morning programme remains the UK’s most listened-to radio show at 6.6 million. Head of Radio 2 Helen Thomas said she was “very proud” of the results. BBC Radio 6 Music also performed strongly, reaching 2.7 million listeners, with Nick Grimshaw’s breakfast show attracting 1.3 million.

Radio 1 remained dominant among younger audiences, with 7.9 million weekly listeners and 4.2 million tuning in for Greg James at breakfast. BBC Radio 4 reached nearly 9 million weekly listeners, with 5.6 million listening to the Today programme. The World Service rose to 1.1 million listeners, while BBC Nations and Local Radio combined reached 6.7 million.

Global has achieved record-breaking RAJAR results for Q3 2025, reaching 29 million weekly listeners and its highest-ever share of 28.1%. Heart remains the UK’s biggest radio brand with 12.8 million listeners, still ahead of the singular BBC Radio 2, while Capital reaches 9.4 million and Smooth 7.6 million. Radio X celebrates a record 2.5 million listeners in its tenth year, alongside strong growth for Heart Dance, Heart 10s, Capital Anthems, and Classic FM Calm. LBC continues to lead talk radio with 3.3 million listeners.

Smooth Radio remained broadly flat. Smooth 70s gained 25.7% in reach (245k → 308k), with hours up 20% and share up 17%. Core Smooth Radio UK slipped 3% in reach but improved hours 1%, leaving share marginally positive. Out of 35 Smooth stations, 13 rose and 22 fell in reach. Smooth Radio Scotland advanced, up 9.8% in reach to 391 000, with share increasing to 7.0%.

The Heart network experienced moderate contraction overall. Heart East Anglia – Suffolk bucked the trend, rising 27% in reach (121k → 154k), hours up 22%, and share up 18%. However, more than half of Heart’s local variants lost audience; cumulative reach across the brand fell 2% quarter-on-quarter. Average hours declined 3%, and network share softened 1%.

Several digital-only stations displayed significant swings. Classic FM Movies dropped 42% in reach (210k → 121k), hours –40%, and share –37%, indicating the spin-off has yet to stabilise. Radio X 90s (Manchester, formerly XS Manchester) improved 25% in reach (75k → 94k), hours up 20%, and share up 18%, marking a successful relaunch under the Radio X umbrella. Smooth 70s is up, Smooth 80s is down, and Smooth London is slightly lower but still above 1 million listeners in the capital. Founder Ashley Tabor-King CBE said the figures show “more people listening for longer than ever before.”

Bauer Media Audio UK now reaches 22.9 million weekly listeners, maintaining its position as the second-largest commercial radio group. Magic Radio rose 8.8% year-on-year to over 2.4 million following a refreshed line-up and major marketing campaign. Absolute Radio’s main station grew 4.9%, with strong gains across its decade spin-offs, while Planet Rock rose 11% and Kerrang! Radio jumped 36%. The Hits Radio and Greatest Hits Radio networks together reach nearly 15 million listeners, with Ken Bruce continuing to anchor the UK’s most listened-to commercial radio show.

Greatest Hits Radio as a single station is down 6% (6.6 million to 6.2 million, –426,000) and down in total hours from 60,827 to 56,680. CEO Simon Myciunka said Bauer’s scale and creativity make it a powerful partner for advertisers. KISS remains above 2 million nationally but lost more listeners in London following the removal of FM. Hits London, now on 100FM, fell from 662,000 to 530,000.

Locally, Greatest Hits Radio (Surrey & East Hampshire) recorded one of the steepest declines, with reach down 43.6% from 50k to 28k, total hours down 40%, and share down 35%. Other regional services such as GHR Cambridgeshire (–28.5% reach, –25% hours, –20% share) and GHR Bradford & West Yorkshire (–22% reach, –19% hours) also moved down, although markets like GHR Norfolk (+12% reach, +10% hours) saw modest recovery. Overall, 20 of 64 GHR licences grew in reach, 44 declined. Greatest Hits Radio saw 17 stations up and 37 down; Surrey and East Hampshire fell 44%, Cambridgeshire 28%, and the North of Scotland 23%.

Hits Radio showed similarly mixed performance. Hits Radio (Plymouth) rose 25% in reach (12k → 15k), hours up 18%, share up 15%. Hits Radio (Peterborough, Stamford & Rutland) matched the pattern with 23.9% reach growth. In contrast, Hits Radio (Cambridgeshire) fell 39.5% in reach and 35% in hours, while Hits Radio (Gloucestershire) slid 31.5% in reach. Across the brand, 12 stations increased and 36 decreased, net –24. Cumulative network reach was 2% lower, hours 3% down, and share 2% down. Hits Radio overall saw 10 stations up and 27 down, with strong increases in Plymouth (+25%) and Peterborough (+24%) but sharp drops in Cambridgeshire (–39%) and Gloucestershire (–32%).

Forth 1 delivered one of the strongest performances in Scotland this quarter, growing reach to 404,000 listeners, up 10% on the quarter, with a strong 19.7% share — one of the highest in the nation. Tay FM also surged, up 16.7% in reach to 133,000, lifting its share sharply to 17.5%.

Clyde 1 remains a powerhouse in Glasgow and the West, holding 729,000 weekly listeners and a commanding 21.0% share, despite a very small slip in reach. Clyde 1 Ayrshire (formerly West FM) plunged 20.3% to 47 000

News Broadcasting recorded 6.3 million weekly listeners and 44.4 million hours across talkSPORT, Virgin Radio, Times Radio, Talk, and U105. It remains the UK’s most digital broadcaster, with 86% of listening from digital platforms and over a third from streaming. talkSPORT led with 3.4 million listeners and a 10.8% annual rise in hours, while Times Radio saw hours up 13.4% year-on-year. Virgin Radio reached 2.1 million, and Talk delivered 5 million hours, up 19% on the quarter. EVP Scott Taunton said the results highlight the group’s success in “creating compelling, multiplatform content” that drives audience growth.

Within the talk and sport category, talkSPORT UK was broadly flat (-1% reach, -2% hours). talkSPORT 2 endured a pronounced slide, down 28% in reach (568k → 408k), 24% in hours, and 20% in share. Times Radio added 3% reach and 5% hours, nudging share up 4%.

Nation Broadcasting has recorded its highest-ever listening hours. Swansea Bay Radio showed dramatic improvement, with reach up 66% (10k → 17k), hours up 60%, and share up 55%, reflecting renewed local engagement following its rebrand earlier this year. However, Nation 80s registered the largest overall loss this quarter, with weekly reach down 59% (348k → 143k), total hours down 55%, and share down 50%. Nation Radio Scotland (excluding West) also fell sharply, down 41.5% in reach (26k → 15k) and 38% in hours.

Easy Radio South has doubled its TSA and increased listeners 21%, Nation 90s debuts on 209,000, and Nation Radio London, now with additional FM carriage, is at 154,000.

Performance across BBC Local Radio was mixed. BBC Radio Somerset posted the network’s strongest growth, with weekly reach up 45% from 40,000 to 58,000, total hours up 20%, and share rising 15%. Lancashire rose 23%, BBC Radio Bristol improved reach 12% and hours 10%, while BBC Derby fell 18% and BBC Radio Gloucestershire dropped 8% in reach but retained its hours. There are 12 stations up, 22 down and two unchanged.

Boom now reports as a group following the addition of Boom Light to RAJAR. Boom Light debuted with 106,000 listeners and nearly one million hours of listening, while Boom Radio is down slightly this quarter, totalling 739,000 combined, but up 17% year-on-year. Co-founder Phil Riley said the figures show “human beings, intelligently curating music radio stations by hand, can continue to hold listeners’ attention and loyalty” as the group expands for older audiences.

GB News Radio has achieved record-breaking growth, overtaking both Times Radio and Talk Radio. Its weekly audience has risen to 684,000, up 25% in three months and 12% year-on-year. In contrast, Talk Radio dropped 12% over the year and Times Radio fell 8% quarter-on-quarter. Every weekday and weekend show reported growth, with Dewbs and Co up 232% and GB News Breakfast rising 147% year-on-year. CEO Angelos Frangopoulos said the figures reflect “fearless journalism” and strong appeal among younger listeners, whose numbers more than doubled quarter-on-quarter.

Original 106 remains the North East’s most listened-to commercial station in Scotland, holding a 16.9% market share. Average listening hours have risen to 9.9 per listener. In Tayside, reach and hours are both climbing, while Original 106 Gold continues to grow with 14,000 listeners and 40,000 hours. Original 106 Fife saw a fall in reach but higher listener loyalty at 7.5 hours. Across all services, the network attracts nearly 150,000 listeners and 1.25 million hours. Robin Galloway said the results highlight the “incredible loyalty” of audiences across the North East, Tayside and Fife.

Lyca Radio and Lyca Gold have reached a combined 192,000 listeners. Lyca Gold recorded its highest ever weekly reach at 109,000, an increase of 17,000, while Lyca Radio attracted 125,000 listeners. Chief Executive Raj Baddhan said the group was “delighted” with the figures and thanked listeners for their continued support as it expands across the UK.

Sunrise Radio has been confirmed as the number one Asian commercial radio station in London with 151,000 listeners. The station has increased both its reach and total hours. Managing Director Tony Lit MBE said he was “delighted” with the results, confirming Sunrise will celebrate its 36th anniversary on 5 November by launching two new radio stations, one in London and one nationwide.

Centreforce 883 declined 41% in reach, 38% in hours, and 35% in share. Mi-Soul fell 35% in reach, 32% in hours, and 30% in share, while CountryLine Radio (formerly Chris Country) lost 27% in reach and 25% in hours.

Outside of RAJAR, Fix Radio has reported their Q3 results from Nielsen. The station’s audience has risen to 833,545 weekly listeners – a 41% year-on-year increase. More than one in four of the UK’s 3.1 million tradespeople now tune in, marking a tenfold rise in reach since the station launched nationally on DAB in May 2022. Listeners are spending an average of 27.9 hours each week with the station.

Founder and CEO Louis Timpany said the growth had exceeded expectations, while programme director Andy Shier credited the success to engaging content created by presenters and producers.

For more RAJAR figures, see the RadioToday Graphs at radiotoday.co.uk/rajar.

RadioToday’s RAJAR reporting is based on comparing quarter-on-quarter weekly reach for each station, even if some stations only have fresh data half-yearly or yearly. We also sometimes mention Hours or Share, but this is clearly marked. Whilst all information is checked, there may be unintentional errors so please check with RAJAR if using this information elsewhere. RadioToday uses data from the Hallett Arendt Comparative Report, and AI to check and rewrite articles where appropriate.